FHA Releases 2024 Loan Limits

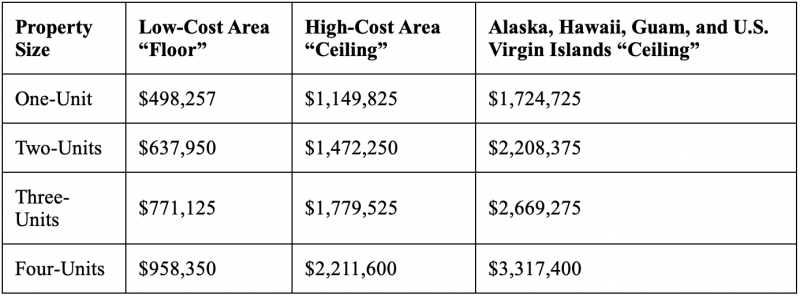

For a one-unit Single Family Title II forward mortgage, the base limit will be $498,257 and go as high as $1,149,825 in selected areas of Fla.

WASHINGTON – The Federal Housing Administration (FHA) announced new loan limits for calendar year 2024 for its Single Family Title II forward and Home Equity Conversion Mortgage (HECM) insurance programs. It says loan limits rose in most U.S. areas.

“The statutory loan limit increases announced today reflect the continued rise in home prices seen throughout most of the nation in 2023,” says Assistant Secretary for Housing and Federal Housing Commissioner Julia Gordon. “The increases … will enable homebuyers to use FHA’s low-down-payment financing … when a lack of affordability threatens to shut well qualified borrowers out of the market.”

FHA is required to update its annual loan limits each year using a formula prescribed in the National Housing Act, which uses county or Metropolitan Statistical Area (MSA) home sale data to derive new loan limits for the three different cost categories established by the law.

The new forward mortgage loan limits in the table below are effective for FHA case numbers assigned on or after Jan. 1, 2024.

HECM loan limits

The Home Equity Conversion Mortgage (HECM) maximum claim amount will increase from $1,089,300 in calendar year 2023 to $1,149,825 for FHA case numbers assigned on or after January 1, 2024.

The maximum claim amount is applicable to all areas, including the special exception areas of Alaska, Hawaii, Guam and the U.S. Virgin Islands.

© 2023 Florida Realtors®

Categories

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "